The year 2022 has been intense for the Southeast Asia financial markets. From the surge in inflation, the perennial effects of Covid-19 and alarming geopolitical conflicts, the resilience of the Financial Services Industry (FSI) has been put to the challenge. But despite the headwinds, the sector has done a great job not just in navigating the climate but as well as in supporting different economic stakeholders in bouncing back. Thanks to the industry’s maturity in advancing its products and making financing more accessible to all.

Looking ahead to 2023, the continuing focus on what’s core to customers remains to be the industry’s strongest tailwind, but brands need to be more nimble to withstand the competition.

Through our close partnerships with FSI organizations, we at GrowthOps observed and summarised the most important emerging industry trends and consumer behavior, along with insights that FSI can make allowances for to prepare for what’s ahead.

New Realities: The Economy on Search

Search trends show that Southeast Asians are worried about the economy. There have been year-on-year increases in searches regarding the increased cost of living, savings, and medical cards, but a big spike is seen in 2022.

Google Trends result shows that the year-to-date search volume for ‘Inflation’ has increased by 73.73% compared to the full year of 2021, 64% for ‘Food Inflation’ and 112% for ‘Global Recession’ across the countries Malaysia, Singapore, Indonesia, Philippines, Hong Kong, Thailand and Vietnam.

Another survey supports these findings which revealed that almost 4 in every 10 Singaporeans feel ‘heavily impacted’ by rising costs, and 74% say they will “save more, and spend less” and will “look for cheaper alternatives”. Moreover, 81% expect the high inflationary trend to persist over the next 12 months and beyond.

Despite official reassurance and a positive macro outlook on the economy, Southeast Asians struggle with the costs of living and are concerned with the future.

Financial institutions must convey reliability and humanity across their brand message during uncertain times. They must be the first to ask their customers how they can help.

New Segments: Gaming and Streaming

Maturing Gen-Z audiences are bringing with them new media behaviors, with a rise in SVOD and gaming.

Southeast Asia is one of the fastest-growing regions for the games market, with 270 million gamers, it’s a $5 billion market size with an estimated compound annual growth rate (CAGR) of 8.6% between 2020 to 2025.

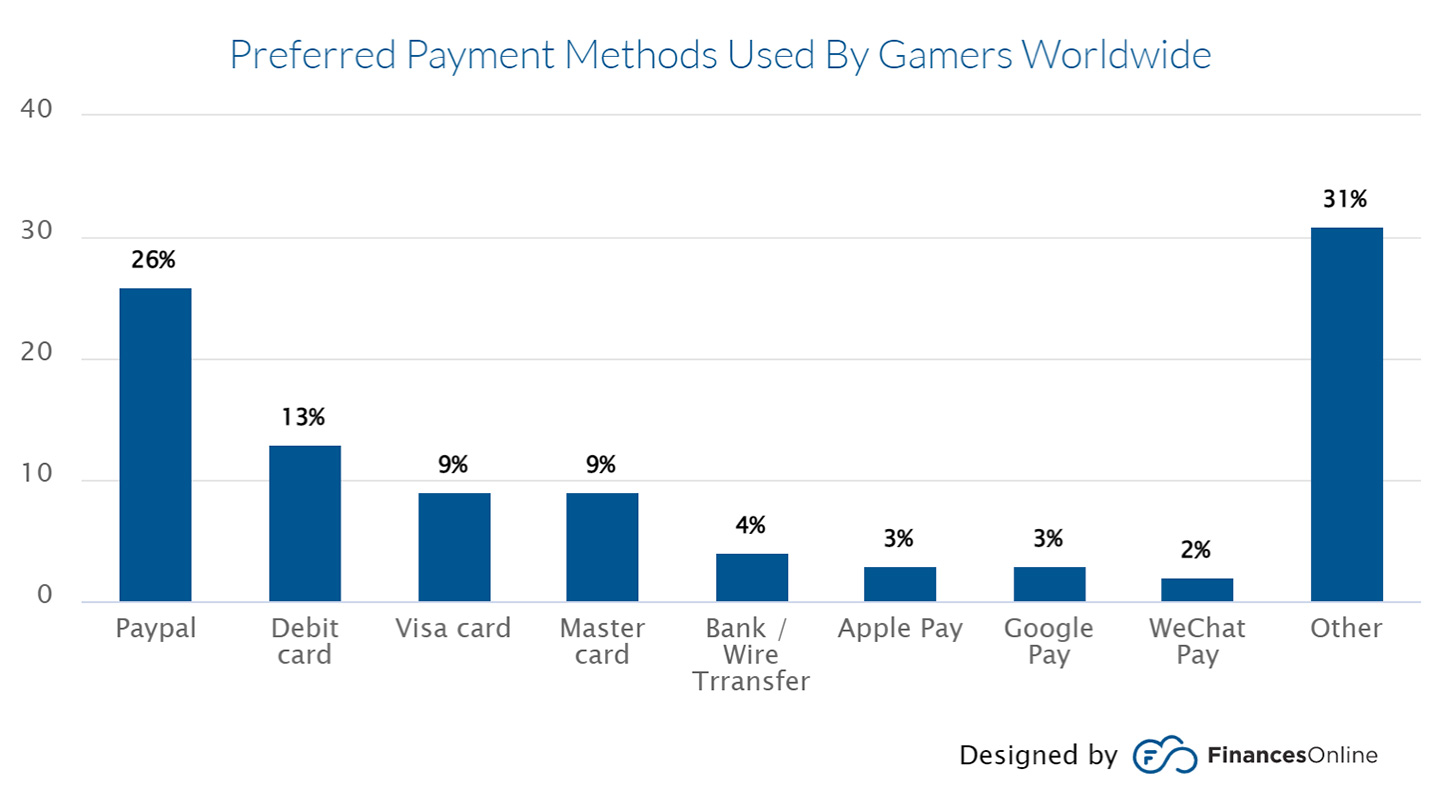

The industry makes a profit from the sale of game titles, hardware and microtransactions such as upgrades. These purchases are mostly facilitated by e-wallets, credit cards and debit card transactions. While credit cards are a preferred payment method, security and usability remain to be an issue, thus the rise of e-wallets. In a 2020 research done by Finance Online, Paypal was seen to be the most preferred payment method by players.

Source: Finances Online

Securing a presence in these areas will be crucial, as the gaming market is extremely active and already financially mature.

New Social/Marketing: Finfluencers

TikTok and other platforms are seeing a new generation of financial gurus drawing large followings.

There is a rise of finance KOLs or ‘finfluencers’ in their 20s that are building strong followings on TikTok. According to Hypeauditor, an AI-Powered Influencer Marketing Platform, finfluencers have experienced a boom, particularly among younger audiences. Their content generally covers investment, personal finance, and running small businesses, though not without concerns regarding KOL reliability.

Overall, finfluencers hold an estimated market size of $104 billion.

The market is eager to consume financial content, but finfluencers are the gateway to accessing that enthusiasm, which requires a large KOL spend to have a competitive brand presence.

New Expectations: Personalized Banking

Global banks are chasing personalization to great success. Adopting the “Netflix of Banking” allowed them to reduce acquisition costs and drive investments by offering customized product recommendations, and consumers love it. Moreover, they are expecting more of this kind of digital experience.

However, they still crave human connection. Consumer trust in banks has dropped as digital penetration rises, and 7 in 10 consumers want a digital experience that includes human advice.

The buzz around “Netflix of Banking” speaks to a deeper basic truth: consumers want to feel spoken to by brands. While the experience is getting more digital than ever before, the need for human connection is evergreen.

New Competition: BNPL and DigiBanks

BNPL payment offers by various superapps are exploding in popularity, threatening traditional credit card products offered by banks. In APAC, BNPL Gross Merchandise Value is expected to increase from US$139.0 billion in 2021 to reach US$782.9 billion by 2028.

BNPL has positioned itself not just as an alternative payment solution, but as a lifestyle. Just recently, one of BNPL brands Atome launched their high-concept fashion magazine in collaboration with their retail brand partners such as Charles & Keith and ALDO.

But despite the rapid adoption, there has been a concern about the risk of customer abuse of the platform which can lead them to face heavy debts. Pundits and audiences have called BNPL practices predatory.

On the other hand, Digital Banking in the region has become more mature and is expected to hit $2 trillion by transaction value in 2030. Thanks to the year-on-year doubling investments, and new players joining the already highly competitive market which pushes everyone to innovate their way to delivering value to the consumers.

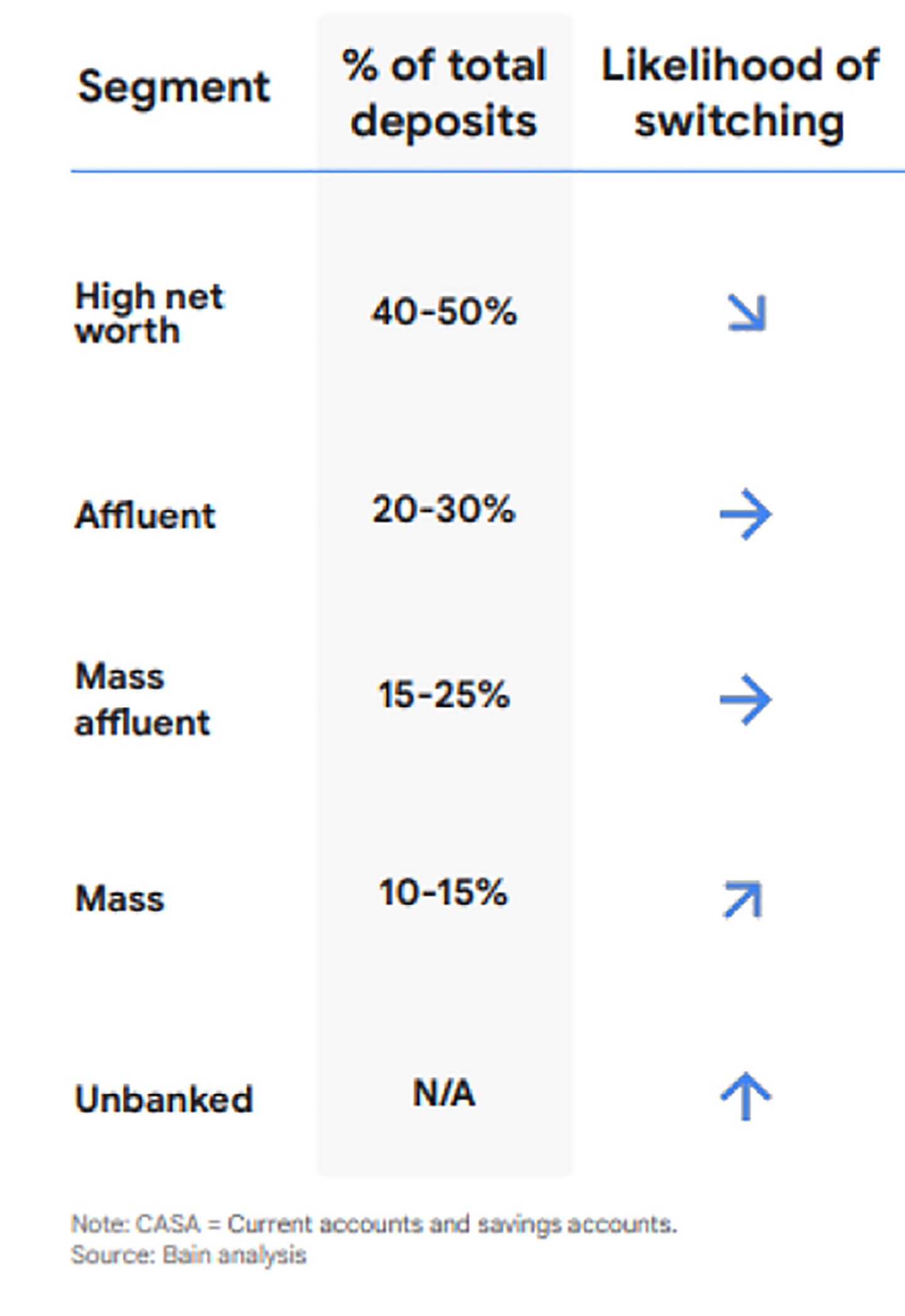

But there are still plenty of opportunities for the providers. Digibanks are now competing for the mass and unbanked sector by capturing opportunities for credit lines.

The case is different for high net worth and affluent consumers who steer 60% to 80% of deposit balances. This sector is more likely to stick with established financial services. But in order to protect their territory, established banks have to get fast in delivering better user experience and more value-added services like digital payments and investments.

Source: Bain Analysis

DigiBank providers are growing fast and experimenting with vibrant new brand exercises, threatening more established bank products; some major bankers have already partnered with these firms in anticipation.

To compete, securing mental availability for credit cards and account products to be first-in-mind among Gen-Z audiences with a purpose-driven comms vision: to provide our customers with the safest, most responsible way to make purchases.

Rapid digitization that gives high-value consumers a better experience and accessibility to services needed should stay a top priority.

New Experiences: The Metaverse and NFTs

The blockchain space is an area to keep an eye on for long-term growth, expansion, and innovation. With the increasing use of connected devices and the adoption of 5G networks, the global immersive reality market size is expected to grow at a CAGR of ~24% until 2035.

Crypto offers a chance to measure brand value with digital assets and tokens associated with financial institutions, with many global brands already experimenting with metaverse brand extensions

However, despite the positive predictions and massive hype around these new digital experiences, the reality is, audiences aren’t there yet.

Decentraland, one of the biggest virtual social platforms averages only around 8,000 users daily despite its over a billion valuation. On one day in October 2022, data aggregator DappRada counted only 38 active users engaging with contracts.

Data suggests that users may not be returning every day, and the product-market fit is still at a very premature stage. And coming from the Metaverse CEO Mark Zuckerberg himself, “It’s not like this stuff is going to be fully mature in a year or even two or three years. It’s going to take a long time to build out the next computing platform.”

The Metaverse and NFT’s offer a few useful opportunities but are a lower-priority space to explore; still, efforts in the area should be made sooner than later to capitalize on the learning process and perceived innovation with audiences.

Brands can start experimenting with necessary technologies in a meaningful way and pushing local innovation while keeping an eye on common concerns (privacy, fraud, money-laundering, environmental impact).

New Rules: First Party Data, Privacy, and Trust

Getting on the first-party data strategy wave is not just a trend anymore, but rather a must for brands, especially for the FSI players who greatly rely on data.

1st party data offer huge opportunities amidst the phasing out of 3rd party cookies.

A case study by Bluestep Bank showed how their strategy of building a data attribution model and using MMM analysis has increased their qualified leads by 25% and reduced their CPA by 20%.

By linking all 1st-party data sources, incremental revenue from a single ad placement can also be doubled.

And If you haven’t migrated to Google Analytics 4 (GA4) yet, doing so should come first in your 2023 calendar. GA4 is Google’s new generation of measurement solution that collects data from websites or mobile apps using a 1st party cookie. It will replace Universal Ana Universal Analytics which is scheduled to sunset on July 1, 2023.

Aside from non-invasive data tracking and collection features, GA4 also comes with better advertising, data enrichment and predictive analytics features to help advertisers optimize campaigns.

New opportunities with 1st-party data require a cohesive data strategy that links all sources together, but to do so we need strong inter-organizational relationships and a heavy messaging and operational emphasis on privacy.

Data strategy needs to link all 1st-party sources together while prioritizing privacy; this gives players opportunities to build custom audiences and cultivate consumer trust.

New Values: ESG and Sustainability

The search interest for ESG has more than doubled in the past three years with a growing momentum in global investment. Now, investment trends are being shaped by ESG, with global flows into ETFs reaching $128 billion.

However, ESG integration has been inconsistent among the financial players in Southeast Asia. While there is interest, there have been varied efforts among major players. Furthermore, recessionary fears are at odds with ESG commitments and brands like Belvidere and Brewdog are showing that trading purpose for authenticity can be effective.

Initial groundwork messaging is crucial to avoid losing out to competitors as sustainability concerns grow. And more than compliance, companies should see ESG as a value creation lever.

Brands need to lay the groundwork and build long-term brand value in the ESG space to capture future interest in sustainability and ESG fund products.

Overall, the trends mentioned add up to strengthening brand trust and reliability. But with the increasing competition among traditional banks and emerging fintech players, it’s not just a man-to-man game of chessboard anymore. Now more than ever, Deep Blue speed and strategic prioritization are needed to grow and defend the players’ current market positions.